It’s turning out to be another very unpredictable year. While inflation is skyrocketing with rates many have never seen before, Alberta is reaping the benefits of shocking energy prices with an estimated $3.9B budgetary surplus – far exceeding what was forecasted. Our province is set to lead the country in economic growth: 5.5% forecasted for 2022. The price of oil is once again catapulting this economic windfall. However, this ‘boom’ is different from the past. Oil companies, having been so battered by collapsing oil prices, are choosing to direct profits towards paying down debt rather than investing in capital.

Data

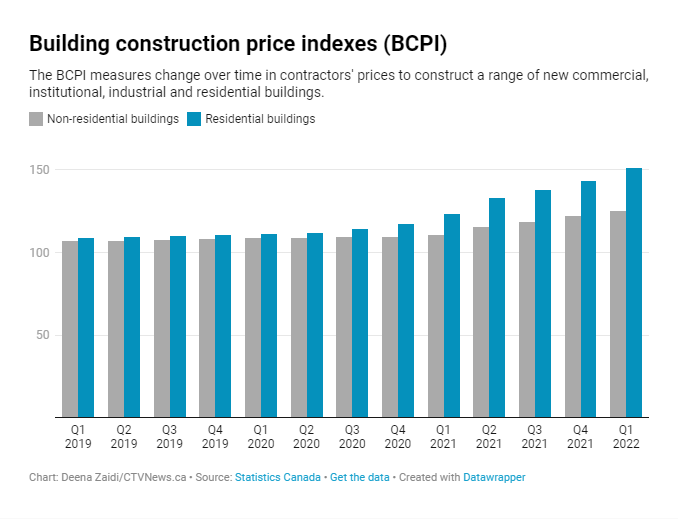

There are three huge challenges in the construction industry: high inflation and labour and supply shortages. Statistics Canada reported a 25% increase in residential construction costs in Q1 of 2022 (see above graph), with non-residential construction a little more than half of that. Although the cost of some raw materials, such as steel and lumber, have declined since late last year, they have been steadily increasing. Fuel volatility has added another layer of unpredictability. Material shortages and extreme pricing fluctuations have made it extremely difficult to estimate and deliver projects within budget.

Inflation has been the target of many central banks across the globe. The Bank of Canada (BOC) recently increased interest rates by 50 basis points to 1.5% with more rate increases on the horizon. While the BOC is targeting inflation with monetary policy, there is pressure on the government to do more to assist Canadians dealing with the high cost of living, which could push inflation further if fiscal support is not thoughtfully targeted. Private sector employment growth has been strong this year. The Calgary Real Estate Board noted that interprovincial migration and international migration increased by 44.2% and 67.8% respectively in the first quarter of 2022. Alberta’s affordable housing market, low tax rate and high average income have led to this growth.

On the Horizon

Consistent and predictable inflation rates were relatively simple to factor into the construction budget – not so in this period of global economic uncertainty. Our material supply chains are more entwined with global production and more volatile than ever before.

How do you best manage the effect of inflation on your construction projects? Many contractors are shying away from fixed price contracts, opting for a model that includes price indexing or cost plus. While this will protect the contractor from cost associated profit erosion, it passes that risk onto the buyer which impacts the ability to secure adequate financing – combine that with interest rate hikes and it will most likely lead to either delaying or shelving projects entirely.

There are a number of actions you can take to help you address inflation and minimize the impacts of it on your business and your customers:

Material: Assess supply chain risks, pre-purchase and inventory materials, include alternate material solutions in the event of supply disruptions.

Payment: Negotiate draw schedules to material procurement or include carrying and inventory costs associated with early procurement into the pricing.

Risk Sharing: Communicate inflation and supply risks with building owners. Share both project cost savings and cost creep.

Schedule: Develop reasonable timelines for project milestones considering the challenges and embed the cost of delays into the project budget.

Sub-trade/supplier management: Choose trades and suppliers based on quality, performance and reliability, not price. Ensure your trades have timely information, the resources they need to succeed and keep them safe on the jobsite. Pay your trades and suppliers a competitive price, treat them well and pay them on time.

Contingency: The typical 5-10% from the total construction budget may not be enough to cover the current pricing volatility. Evaluate the material supply chain and labour shortage risks and consider increasing this amount in your budget.

Looking Forward

When will inflation become transitory? Economists and the BOC have varying opinions on this topic and there are many uncontrollable geopolitical risks influencing it, despite the actions of central banks and governments throughout the world. COVID-19 was initially to blame for supply chain disruptions… and the war added fuel to the raging fire.

Unquestionably, inflation has been a hot topic for the past 6 months and most recent data revealed that it is persistently increasing and wreaking havoc in global markets as central banks aggressively target inflation to reign it into an acceptable range.

Higher interest rates will impact debt servicing costs, dampen economic activity and may lead to a recession; however, persistent inflation erodes purchasing power, distorts economic decisions and harms long term economic growth.

Will we ever return to the pre-pandemic low inflation environment that central banks can mediate with volatile geopolitical forces, unpredictable global economic shocks and energy disruptions? This is something many global central bank chiefs are questioning as they develop sound economic policies in an ever-changing world.